What Are The Types Of Reverse Mortgages

There are different types of reverse mortgages, and each one fits a different financial need.

- Home Equity Conversion Mortgage The most popular type of reverse mortgage, these federally-insured mortgages usually have higher upfront costs, but the funds can be used for any purpose. In addition, you can choose how the money is withdrawn, such as fixed monthly payments or a line of credit . Although widely available, HECMs are only offered by Federal Housing Administration -approved lenders, and before closing, all borrowers must receive HUD-approved counseling.

- Proprietary reverse mortgage This is a private loan not backed by the government. You can typically receive a larger loan advance from this type of reverse mortgage, especially if you have a higher-valued home.

- Single-purpose reverse mortgage This mortgage is not as common as the other two, and is usually offered by nonprofit organizations and state and local government agencies. A single-purpose mortgage is generally the least expensive of the three options however, borrowers can only use the loan to cover one specific purpose, such as a handicap accessible remodel, explains Jackie Boies, a senior director of housing and bankruptcy services for Money Management International, a nonprofit debt counselor based in Sugar Land, Texas.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Can Dependents Live In My House If I Move To Long

Unfortunately, once the last person who took out the loan has left the home for more than 12 consecutive months, the reverse mortgage will need to be repaid. Typically, this involves selling the house and repaying the loan balance using the proceeds. Any adult dependents will need to find other accommodations.

You May Like: How To Calculate Mortgage Payoff Amount

Understanding The Types Of Reverse Mortgages

There are two types of reverse mortgages available in Minnesota:

Reverse Mortgage And Home Equity Release

How to decide if home equity release is right for you

Page reading time: 9 minutes

If you’re age 60 or over, own your home and need to access money, releasing equity from your home may be an option.

There is risk involved and a long-term financial impact. Get independent financial or legal advice before you go ahead.

You May Like: Does Your Credit Score Affect Mortgage Rate

How Much Equity Do I Need

The more equity you have in your home, the more likely it is that you can get cash from a reverse mortgage to supplement your retirement income, cover health care expenses, or take a trip. As a general rule of thumb, your equity should be at least 50% of your homes value. As home values have risen in 2021, many homeowners are finding they can qualify for a larger amount than in the past. Use our reverse mortgage calculator to see how much you could qualify to receive.

Why Dont Big Banks Offer Reverse Mortgages

Historically, some big banks have offered reverse mortgages. In fact, Bank of America and Wells Fargowere among some of the largest reverse mortgage lenders at one point in time.

Following the financial crisis, however, both of those banks decided to discontinue their reverse mortgage operations. Bank of America announced in February 2011 that it would exit the reverse mortgage business, and Wells Fargo made a similar announcement later that year.

Wells Fargo originated more than 16,000 reverse mortgages in the prior year. Bank of America stated that reverse mortgages were not part of the companys core business at the time.

Wells Fargo stated that with home price unpredictability, it was difficult to determine whether reverse mortgage borrowers would be able to meet their loan obligations.

Also Check: How To Shop Multiple Mortgage Lenders

Who Owns The House In A Reverse Mortgage

Just like any other type of mortgage, you own the home in a reverse mortgage situation.

When the borrower dies or moves, however, the mortgage is payable in full. If you cant, or wont, pay off the debt, the lender can sell the home to recoup the money its owed, explains Michael Sullivan, personal financial consultant with nonprofit credit counseling and debt management agency Take Charge America.

Typically, the homeowner or beneficiaries are not responsible for any costs if the house is sold for less than the amount owed, adds Sullivan.

Reverse Mortgage Impact On Medicaid Eligibility

My mom has a reverse mortgage on her home and she needs to apply for Medicaid. Does this count as income? What should we do?

No, a reverse mortgage does not count as income, and therefore, will not count towards Medicaids income limit. However, Medicaid also has an asset limit, and in some cases, a reverse mortgage counts as an asset. Please note: Generally speaking, the asset limit is $2,000, but homes are exempt to a certain value and if the owner resides in the home. If a reverse mortgage puts your mom over the asset limit, she will not qualify for Medicaid until she spends down the excess assets. .

A reverse mortgage, also called a home equity converse mortgage, is a cash loan against ones home equity value. If the approved loan amount is taken as a lump sum payment, and a Medicaid applicant is sitting on this cash, it can cause him / her to be over the asset limit, and therefore, ineligible for Medicaid. That said, if your mom has received a lump sum payment, it is important that she spend it prior to applying for Medicaid. Otherwise, it will count as an asset. There is also the option to receive monthly cash payments, which as mentioned previously, do not count as income. However, if the loan payment is not spent during the month it is received, it will count as an asset, and again, can result in Medicaid ineligibility.

You May Like: Can You Add A Name To A Mortgage

Are There Fees Associated With Reverse Mortgages

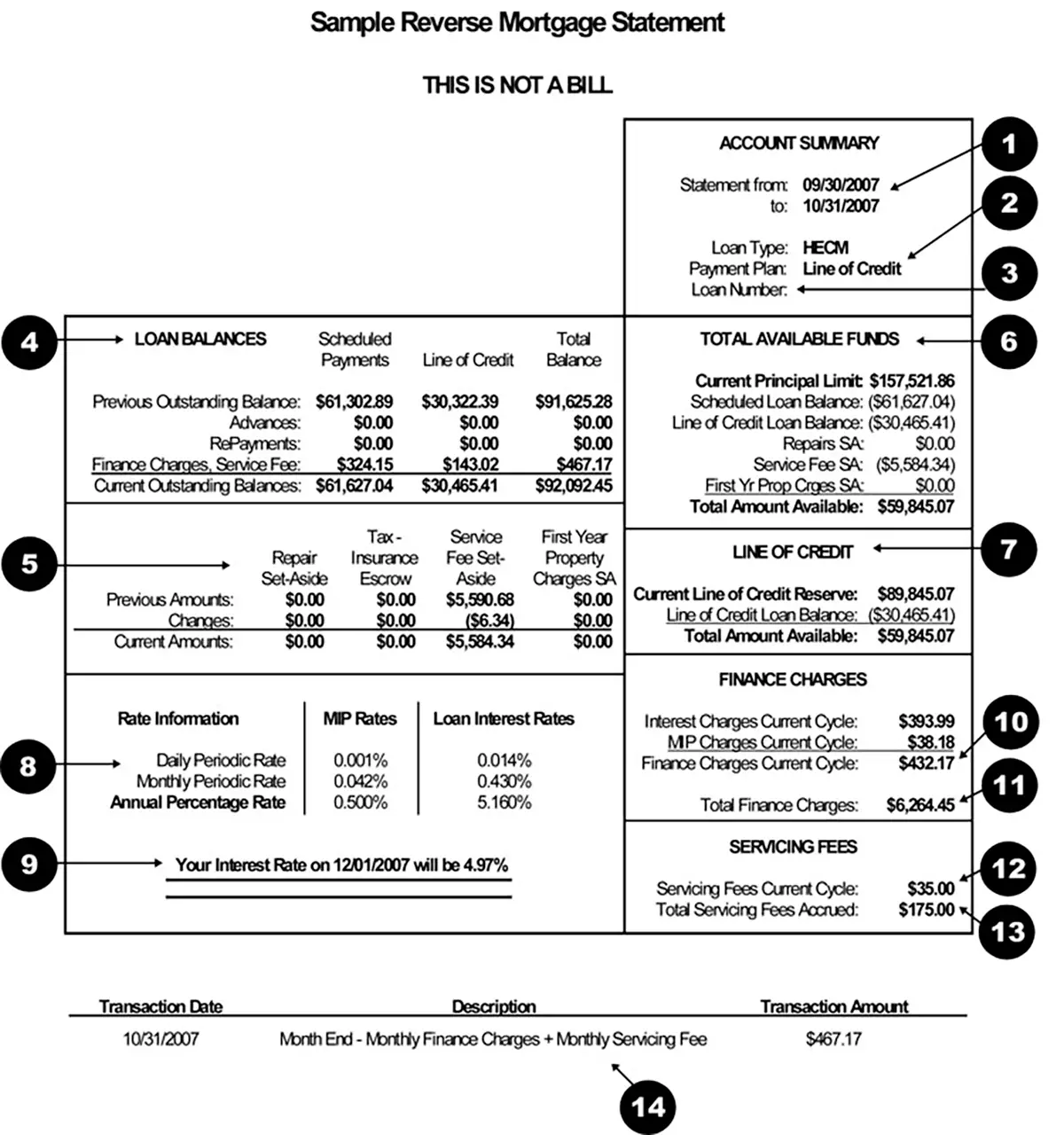

As with all mortgages, there are costs and fees connected to securing a reverse mortgage. Fees include those associated with loan origination, mortgage insurance premiums, closing costs, and monthly servicing fees. These fees are often higher than the fees associated with traditional mortgages and home equity loans. Make sure you understand all the costs and fees associated with the reverse mortgage.

Be aware that if you choose to finance the costs associated with a reverse mortgage, they will increase your loan balance and accrue interest during the life of the loan.

Age Of The Younger Borrower

Age is another key factor that affects how much you can borrow. Lenders consider the age of the youngest borrower to know how long they will have the loan, how long the interest will accrue, and how long it can take to receive payments. Typically, older borrowers can get higher loan amounts than younger borrowers. For example, an 80-year-old senior homeowner can borrow significantly more than a 65-year-old would.

Also Check: Does Applying For A Mortgage Affect Your Credit Score

How Does A Reverse Mortgage Work

Despite the reverse mortgage concept in practice, qualified homeowners may not be able to borrow the entire value of their home even if the mortgage is paid off.

The amount a homeowner can borrow, known as the principal limit, varies based on the age of the youngest borrower or eligible non-borrowing spouse, current interest rates, the HECM mortgage limit and the homes value.

Homeowners are likely to receive a higher principal limit the older they are, the more the property is worth and the lower the interest rate. The amount might increase if the borrower has a variable-rate HECM. With a variable rate, options include:

- Equal monthly payments, provided at least one borrower lives in the property as their primary residence

- Equal monthly payments for a fixed period of months agreed on ahead of time

- A line of credit that can be accessed until it runs out

- A combination of a line of credit and fixed monthly payments for as long as you live in the home

- A combination of a line of credit plus fixed monthly payments for a set length of time

If you choose a HECM with a fixed interest rate, on the other hand, youll receive a single-disbursement, lump-sum payment.

The interest on a reverse mortgage accrues every month, and youll still need to have adequate income to continue to pay for property taxes, homeowners insurance and upkeep of the home.

Finance Of America Reverse

One of the reasons we like Finance of America Reverse is because of its unique loan options. Finance of America offers a traditional reverse mortgage, reverse mortgage for purchase, and jumbo reverse mortgages.

But it also offers a mortgage called EquityAvail, which is a hybrid between a reverse mortgage and a traditional mortgage. EquityAvail works by reducing mortgage payments for the first 10 years and then eliminating mortgage payments when the 10-year term is over. And homeowners also have the potential to receive a lump sum payout at that point. This EquityAvail mortgage is available for homeowners who are a minimum of 55 years old.

Another unique service that Finance of America offers is its home sharing matching platform called Silvernest. Silvernest gives those who may have additional rooms to rent a way to make additional income.

Finance of America also has high customer service ratings on third party review websites and is licensed in all 50 states and the District of Columbia and Puerto Rico.

Read our full Finance of America Reverse review.

Recommended Reading: Are Rocket Mortgage Rates Competitive

You Must Meet Minimum Income Requirements

Many people who apply for reverse mortgages are either nearing retirement or are already in retirement, so they no longer have income from a full-time job.

Social Security income is a consideration for applicants, as are any other forms of income such as part-time work or rental income.

In some cases, applicants are denied because they dont have enough income coming in each month to keep up on the estimated property charges but more borrowers than not are given an opportunity to still obtain a reverse mortgage by setting funds aside from their loan to pay for their property charges as they come due.

This relatively new feature for reverse mortgage borrowers that can help some applicants qualify even if they do not meet the credit or income requirements is known as a Life Expectancy Set Aside or Lee-sah.

Set aside rules were implemented in 2015 allowing lenders to essentially set aside funds borrowers will need to pay for their property charges. The LESA will help borrowers with some credit issues that may not have been approved on their own but whose credit is not so terrible that it warrants a loan declination no matter what.

HUD wants to make the reverse mortgage program available to all borrowers that the loan would truly help but if the borrowers positions are not better even after the closing of a reverse mortgage, HUD does not want to delay the inevitable loss of the home.

What Types Of Homes Qualify

The most common types of homes to qualify for reverse mortgage loans are single-family homes. However, multi-family homes can also qualify, as long as one of the four units serves as the borrowers primary residence. Manufactured homes can qualify if they meet Federal Housing Administration requirements. Condominiums can also qualify for a reverse mortgage, following specific guidelines from the Department of Housing and Urban Development .

Don’t Miss: How Much Mortgage Would I Get

How An Equity Release Agreement Works

One option is for one or more investors to buy portions of your home’s equity through a property investment fund. You pay fees which are periodically deducted from the remaining equity in your home. The investor’s share of your home’s equity goes up over time, and yours goes down.

For example, suppose your home is currently worth $500,000. You sell 20% of your home’s equity in return for a lump sum of $100,000. The fee charged by the fund may vary, depending on your circumstances and the agreement. If the fund charges an initial fee of $30,000, it may take $130,000 of your equity to cover both the lump sum and periodic fee.

Additional amounts of equity are deducted each time the periodic fee falls due . The fee is a set percentage of the fund’s equity in your home. So, as the fund’s share of equity increases, the fee goes up.

When the equity release agreement ends, and your home is sold, the fund gets their share of the proceeds. That is, the proportion of your home’s equity they have accrued. You or your deceased estate get the remainder of the proceeds, if any.

The proportion of home equity you keep will reduce over time, and could even go down to zero.

Check your agreement to see what happens if your equity goes down to zero. Make sure you can continue living in your home, until sold by you or your deceased estate.

Theres A Lending Limit For Hecm Loans

As great as it would be to borrow an unlimited sum of money, the reality is, homeowners can only borrow according to Department of Housing and Urban Development rules.

As determined by the Federal Housing Administration, the Home Equity Conversion Mortgage reverse mortgage limit is currently $970,800.

But not everyone will be able to receive the maximum amount. Factors that determine how much money someone can borrow through a HECM reverse mortgage include:

- Age of the youngest borrower

- Appraised value of the home

- Current interest rates

Also Check: How To Calculate Dti Ratio For Mortgage

Reverse Mortgage Lending Authority

Pursuant to 3 NYCRR 79.3, The Department of Financial Services accepts applications to engage in reverse mortgage lending activity.

New York licensed mortgage bankers that wish to engage in reverse mortgage lending activity must apply for authority to conduct reverse mortgage lending. Applicants can apply for either of the following authority:

- Reverse Mortgage Lending Authority

- Restricted to the origination of Home Equity Conversion Mortgages by an FHA approved Non-supervised lender with Title II HECM authority.

How Much Does Mortgage Insurance Cost

If you have a HECM reverse mortgage, your lender will charge you a 2% upfront mortgage insurance premium based on your home’s appraised value, up to the $970,800 maximum lending limit.

After that, an annual MIP kicks in, equal to 0.5% of your loan’s outstanding balance. Proprietary reverse mortgages don’t generally require mortgage insurance, but they tend to have higher interest rates and fewer consumer protections.

Read Also: Do Different Banks Offer Different Mortgage Rates

Am I Eligible For A Hecm Reverse Mortgage

- You must be age 62 or older .

- You must live in the home as your principal residence.

- The home must meet minimum property standards set by the U.S. Department of Housing and Urban Development however, you may be able to use your reverse mortgage proceeds to pay for the required repairs to meet them.

- You cant have any outstanding federal tax liens and must have made your property tax payments for the last two years.

The Reverse Mortgage Principal Limit

The most common type of reverse mortgage is the Home Equity Conversion Mortgage . This is also the only type of reverse mortgage that is insured by the Federal Housing Administration .

Because HECM reverse mortgages are backed by the federal government, it has created rules and guidelines around how they work including how to calculate how much homeowners may borrow.

The amount you are able to borrow with a reverse mortgage is called the principal limit.

This is calculated based on the age of the youngest borrower, the interest rate, and the maximum claim amount.

We will go over these factors plus others that may affect how much you are able to borrow with a reverse mortgage.

Don’t Miss: What Is Mortgage Debt To Income Ratio

What A Reverse Mortgage Costs

The cost of the loan depends on:

- how much you borrow

- how you take the amount you borrow

- the interest rate and fees

- how long you have the loan

Over time, your debt will grow and your equity will decrease .

See how much a reverse mortgage would cost over different time periods, such as 10 or 20 years.

Your lender or broker must go through reverse mortgage projections with you, showing the impact on your home equity over time. Get a copy of this to take away, and discuss it with your adviser. Ask questions if there’s anything you’re not sure about.

How To Sell A House With A Reverse Mortgage

You must repay your reverse mortgage loan when you sell the home, after which your lender will close the account. Here’s a rundown of the basic steps:

- Contact your lender. Request a payoff quote , including any money you have received, accrued interest, and other fees. The lender will mail a due and payable letter within 30 days, specifying the current loan balance, options for repayment, steps to avoid foreclosure, and the number of days to respond. The lender will send an appraiser to determine the property’s value.

- List and sell the home. When determining the price, consider your mortgage balance and closing costs. A real estate agent, broker, or Realtor can help set the price, handle showings, negotiate with potential buyers, and ensure a smooth closing. If your state requires it , hire a real estate attorney to assist with the process.

- Close and transfer the funds. At closing, your reverse mortgage lender receives the loan payoff amount, and you receive any excess proceeds minus closing costs.

Interest, mortgage insurance premiums , and homeowners insurance continue to accrue until the loan is paid and settled, so your loan balance will keep growing during the settlement period.

Also Check: What Is Principal Mortgage Insurance